Content:

- CBDC - what is it and why are countries starting to implement it en masse?

- What is CBDC and where is it stored?

- About CBDC

- Is digital money a cryptocurrency?

- Benefits of CBDC

- Disadvantages of CBDC

- Characteristics of CBDC

- Types of CBDC

- How does CBDC work?

- Countries participating in the implementation of the digital currency CBDC

- Cross-border CBDC projects

CBDC - the new digital currency of the world

CBDC - What Is It and Why Are Countries Massively Implementing It?

The traditional financial market remains vulnerable to threats, as evidenced by the March drop of Silicon Valley Bank, the second-largest bank in the United States, which could potentially trigger a new economic crisis.

It's evident that nations are seeking to shield themselves from such a "domino effect" and create a new alternative. One of these alternatives could be Central Bank Digital Currency (CBDC). Let's delve into what digital currency is and why it is so crucial.

During the COVID-19 coronavirus pandemic, there was a pressing need for the digitalization of society. This digitalization could help enhance the efficiency of government policies, address issues in the traditional financial system, and more. Additionally, the crypto industry emerged as a sphere of life that resisted direct government oversight.

In this context, Central Bank Digital Currency (CBDC) was introduced, serving as a digital currency issued by a central bank.The pandemic acted as a catalyst for changing payment habits for the majority of the world's population. Non-cash payment methods became the most relevant, as banknotes were not widely accepted. Simultaneously, amidst an economic crisis, again driven by the consequences of the coronavirus, the market positions and capitalization of cryptocurrencies surged.

Countries with a significant share of the global GDP couldn't ignore this trend. Thus, digital currency became a response to these challenges, and its impact on the market is currently under study.

China emerged as one of the pioneers in this direction. The estimated transaction volume using digital yuan is equivalent to $13 billion, with over 260 million users.

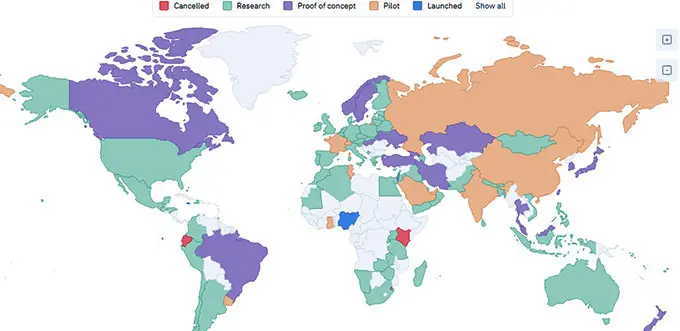

As of today, most countries worldwide have shown interest in CBDC, with nine nations and overseas territories (Caribbean nations and Nigeria) having already introduced digital currency into circulation. Others are currently exploring the possibility of CBDC implementation or monitoring pilot projects. In this article, we will explore the concept of CBDC, its key features, and the advantages it offers to a nation.

CBDC - What Is It and Where Is It Stored?

CBDC (Central Bank Digital Currency) is a new form of digital currency issued and controlled by a country's central bank. It represents a full-fledged equivalent of the national currency and can be used as a means of payment. The main difference with CBDC is that it exists exclusively in electronic form and can be stored in virtual wallets.

An electronic wallet for CBDC is similar to popular banking applications. It is a software application with a user-friendly interface that allows users to make payments, transfer funds, monitor balances, invest, and perform other financial transactions.

Key characteristics of CBDC include

Tied to the National Currency:

CBDC has a 1:1 ratio with the fiat (traditional) currency of the country and is under the control of the central bank.

Central Bank Control: CBDC is issued and controlled by the central bank, making it different from cryptocurrencies that exist in decentralized and anonymous environments.

Possible Absence of Blockchain:

Not all CBDCs use blockchain technology.

Stable Value:

Unlike cryptocurrencies, the value of CBDC is much more stable and not subject to significant price fluctuations.

CBDCs share similarities with so-called "stablecoins," but there are substantial differences. Stablecoins are issued by private entities based on provided fiat currency, whereas CBDCs are government-controlled and represent a digital version of the national fiat currency.

CBDCs also differ from non-cash payment methods since when using them, citizens have a direct connection with the central bank, bypassing commercial banks. It is also not necessary to have a bank account; having an electronic device is sufficient. One implementation option for CBDC involves creating "universal bank accounts in central banks."

About CBDC

Central bank digital currencies are digital versions of national currencies controlled by central banks banks.

But how widespread is the interest in CBDC? According to the IMF, almost 110 countries are actively considering central bank digital currencies (CBDCs), and some have already begun their deployment.

Central Bank Digital Currency (CBDC) is a digital counterpart of fiat currency, pegged to it in a 1:1 ratio and issued and controlled by the central bank. This is the main difference between CBDC and cryptocurrencies, which exist in a decentralized and anonymous environment. Additionally, it is expected that not all CBDCs will use blockchain technology. Finally, cryptocurrencies are subject to significant price fluctuations that depend on current supply and demand, while the value of CBDC is much more stable.

Resembling Stablecoins?

Yes, there is some resemblance, but there is still a difference. Stablecoins are issued by private entities in exchange for provided fiat currency, while CBDCs are under government control and essentially represent fiat in a digital form.

CBDCs Differ from Digital Payments

Centralization: When using CBDC, citizens will have direct interaction with the central bank, bypassing commercial banks, making it centralized. In contrast, digital payments typically involve commercial banks as intermediaries.

Bank Accounts: With CBDC, citizens may not need a bank account, whereas traditional digital payments usually require one.CBDC represents a novel form of digital currency with its own characteristics and advantages compared to cryptocurrencies, stablecoins, and traditional digital payments.

CBDC represents a new form of digital currency with its own characteristics and advantages compared to cryptocurrencies, stablecoins, and traditional digital payment methods.

Is digital money a cryptocurrency?

No, digital currencies and cryptocurrencies are distinct concepts:

Digital Currencies (Including CBDCs):

These are digital representations of a country's official currency and are typically issued and regulated by the government or central bank. Central Bank Digital Currencies (CBDCs) are a type of digital currency that is backed by a government or central bank and is considered legal tender. They are designed to provide a secure and stable form of digital payment. CBDCs are centralized and operate within a controlled framework.

Cryptocurrencies:

These are decentralized digital assets that use cryptography for security and operate on blockchain technology. Cryptocurrencies like Bitcoin and Ethereum are not issued or regulated by any central authority or government. They rely on a decentralized network of computers (nodes) to validate and record transactions. Cryptocurrencies are known for their decentralization, anonymity, and often, speculative nature.

While both digital currencies and cryptocurrencies are forms of digital assets, they have significant differences in terms of their issuance, regulation, governance, and use cases. Digital currencies, particularly CBDCs, are typically seen as a more regulated and stable form of digital payment, whereas cryptocurrencies offer decentralization and unique features like Smart-Contracts, but they can also be more volatile and less regulated.

Benefits of CBDC (Central Bank Digital Currency)

Enhanced Security for Banks and Electronic Payment Systems:

Improved security measures for banks and electronic payment systems.

Stabilization of Credit Risks:

Mitigation of credit risks through CBDC implementation.

Faster and Cheaper Cross-Border Payments:

Addressing four main challenges in cross-border payments: high costs, low speed, limited access, and lack of transparency.

For example, the average cost of a $200 payment is approximately $14, with transfer times ranging from three to five days.

Reduction of Dependency on Intermediaries:

Cross-border CBDCs can reduce reliance on intermediaries, thus cutting transaction costs and processing times.

54% of central banks expect CBDCs to significantly reduce the cost of cross-border transactions, with an additional 31% anticipating substantial cost savings.

Image Enhancement for the State and Its Central Bank:

CBDCs can improve the image and reputation of a country's central bank.

Increased Investment Attractiveness:

CBDC transparency appeals to investors, making them more willing to invest in the country's projects.

Reduction of Payment Service Costs through Blockchain Technology:

Leveraging blockchain-based digital currency to decrease payment processing expenses.

Decrease in Shadow Transactions:

CBDCs can reduce shadow or illicit transactions by enhancing transparency.

24/7 Access to Financial Payments:

CBDCs offer round-the-clock payment access through various channels, including mobile devices, smart cards, and applications.

Financial Inclusivity:

Cash is more financially inclusive than traditional bank accounts, which require financial literacy, resources, and documentation to open.

Faster Transaction Processing:

CBDCs can significantly outperform outdated payment systems, processing over 50,000 transactions per second with stable fees. In contrast, the average for VISA is approximately 5,000 transactions per second.

Cost Efficiency and Reduced Errors:

CBDCs are cheaper than using credit cards like VISA or Mastercard, while also decreasing the likelihood of errors, fraud, and reconciliations due to secure transaction recording.

Offline and Low-Connectivity Transactions:

Blockchain technology enables CBDCs to verify and process transactions even in offline or low-connectivity environments, benefiting countries with limited internet infrastructure.

Combating Corruption:

CBDC technology can enhance transparency and aid in the fight against money laundering, supporting government and IMF anti-corruption efforts. Features like eCurrency Information and Supervision in CBDC platforms enable central banks to monitor currency movements, wallets, transactions, and more in real-time, enhancing oversight and data accessibility for macroeconomic analysis and individual wallet tracking.

Drawbacks of CBDC (Central Bank Digital Currency)

Disruption of Traditional Banking System:

CBDC adoption may lead to a decline in traditional banking services, potentially affecting their viability.

Loss of Competitive Edge for Electronic Payment Systems:

Existing electronic payment systems may lose their competitive advantage as CBDCs become the preferred digital currency.

Difficulty in Deploying Funds Following Withdrawal from Banks:

As funds flow out of traditional banks into CBDCs, companies may face challenges in managing their liquidity and financial operations.

Heavy Reliance on Central Banks and Government:

CBDCs place significant responsibilities on central banks and governments, potentially leading to a centralized financial system.

Total Surveillance of Citizens' Financial Transactions:

CBDCs allow for comprehensive monitoring of citizens' financial activities, raising concerns about privacy and government surveillance.

Artificial Economic Stimulus:

CBDCs may be used by governments to artificially stimulate the economy, potentially leading to inflation and economic instability.

Confiscation of "Excess" Individual Funds:

Governments could use CBDCs to impose limits on individual savings or seize funds they consider excessive.

Centralized Control:

CBDCs enable centralized control over financial transactions, limiting individual financial autonomy.

Absolute Citizen Surveillance:

The use of CBDCs can lead to increased government surveillance of citizens' financial behavior.

State Monopolization of the Economy:

CBDCs may lead to greater state control over the economy, potentially stifling competition and innovation.

Introduction of Basic Income for Citizens:

Governments could use CBDCs to implement universal basic income, which may have economic implications.

Implementation of Social Credit Systems:

CBDCs could facilitate the creation of social credit systems that evaluate and control individuals' behavior based on financial transactions.

Impact on Small and Medium-sized Businesses:

CBDCs might disadvantage small and medium-sized enterprises while benefiting large corporations.

Territorial Limits of Digital Money:

CBDCs may have limited cross-border use, potentially complicating international transactions.

Control Over CBDC Emission:

Governments have the power to control the issuance of CBDCs, potentially influencing economic stability.

Prohibition of CBDC Mining:

Some governments may prohibit the mining of their official digital currency, limiting decentralization.

Restrictions on Savings:

CBDCs may introduce restrictions on individuals' savings, affecting their financial planning.

Finite Lifespan of Digital Money:

The theoretical expiration date of CBDCs may incentivize people to spend their digital money quickly, potentially affecting economic behavior.

Discouragement of Savings:

The availability of CBDCs may discourage individuals from saving money due to concerns about devaluation or expiration.

The introduction of CBDC could worsen financial inequality by widening the digital divide. Not everyone has access to the technologies necessary to use them. This can greatly impact low-income and rural communities, leading to further financial exclusion.

Characteristics of CBDC (Central Bank Digital Currency)

Central Bank Digital Currency:

CBDC is a digital version of a currency issued and guaranteed by the central bank of a country. It holds the same status and functions as physical banknotes, including being a means of payment, a unit of account, and a store of value.

Security and Identification:

CBDC's security is ensured through the use of advanced computer encryption methods, making it highly resistant to counterfeiting and providing protection against fraud.

Part of the Money Supply:

CBDC is part of the money supply of the economy and is controlled and issued by the central bank. It is responsible for the level of money supply and price stability.

Storage and Transmission:

Digital currency can be stored and transmitted through various digital payment systems and services, making it convenient for use in online transactions and e-commerce.

Limitation on the Role of Commercial Organizations and Payment Systems:

The introduction of CBDC may limit the participation of commercial organizations and electronic payment systems in processing transactions involving digital currency. This could lead to a reduced significance of their intermediary role.

Universal Bank Accounts:

One possible approach to CBDC implementation involves creating universal bank accounts at central banks for all citizens. This can make access to digital currency more universal and convenient for the population.

CBDC represents an evolution in the monetary system that has the potential to change how individuals, companies, and governments interact with the financial infrastructure. However, the implementation of CBDC also comes with a set of challenges and risks, including the need to strike a balance between innovation and the risks associated with digital currencies.

Types of CBDC (Central Bank Digital Currency)

There are two main types of CBDC:

Wholesale CBDC:

Wholesale CBDC is accessible only to a small number of participants in the financial market, typically financial institutions.

It is primarily designed for interbank settlements and may not have a significant impact on the broader economy.

Wholesale CBDC is mainly used for large-scale financial transactions between banks and other financial entities.

Retail CBDC:

Retail CBDC is designed for everyday use by ordinary citizens and businesses.

It allows the general public to have direct access to the digital currency, and its usage can have a more substantial influence on the overall economy.

Retail CBDC can be used for a wide range of transactions, including payments for goods and services, savings, and day-to-day financial activities.

These two types of CBDC serve different purposes and have varying implications for the financial system and the broader economy. While wholesale CBDC primarily caters to the needs of financial institutions, retail CBDC is intended to provide individuals and businesses with a digital alternative to physical cash for their financial transactions.

How CBDC Works

There are three implementation models for CBDC, and countries are exploring a balance between them:

Financial Institution Access (Model FI):- In this model, only banks and non-bank financial institutions (NBFIs) have access to the digital currency.

- It enables these financial entities to conduct instant, low-cost, and secure transactions using CBDC.

- The central bank maintains its traditional role in the financial system.

Economy-Wide Access (Model EW):

- In addition to banks and NBFIs, companies and businesses also have access to the digital currency.

- However, smaller economic agents may not interact directly with the central bank to acquire CBDC.

- A CBDC exchange and user interface infrastructure, supported by third parties, are created to facilitate transactions for these entities.

Financial Institution Access Plus Limited Bank Access Supported by CBDC (Model FI+):

- In this model, access to CBDC is limited for all banks and NBFIs.

- At least one NBFI operates as a "narrow bank," providing financial assets to companies and businesses.

- The risk profile of the chosen NBFI is independent of the risk associated with the financial activities of the institution and its borrowers.

- This means that accepting and redeeming deposits with this NBFI is not tied to intermediation to support CBDC operations.

The organization of this model is intentionally designed to explore the advantages and disadvantages of different levels of access to central bank digital currency for companies and businesses.

These models reflect the various approaches that countries can take when implementing CBDC, and the choice of model depends on the specific goals and requirements of each central bank and the broader financial ecosystem.

Countries Implementing CBDC (Central Bank Digital Currency):

Bank of England Deputy Governor for Monetary Policy Ben Broadbent, on behalf of the Bank of England, convinced most countries to implement their own CBDC projects in 2017. According to research results, the model has a positive impact, and the only drawback is the attendant difficulties in fully integrating into the economy.

However, not everyone is in a hurry to test the model, and sometimes even refuse. Read about the reasons and detailed status of each country individually in the CBDC issue on this page further

The simplified economic system of underdeveloped countries allows them to test technology first. The implementation of CBDC significantly improves their image in the eyes of key states and opens up new financial opportunities.

CBDC adoption and implementation have been explored by numerous countries.

About 110 countries are on the path to implementing and developing CBDC. While the status of CBDC projects can change over time, here is a general overview of some countries that have been actively considering or testing CBDC:

China:

China:

China is one of the most prominent countries in the CBDC space. It has been conducting extensive trials of its digital yuan (e-CNY) in various cities.

Sweden:

Sweden:

The Riksbank, Sweden's central bank, has been studying the potential issuance of an e-krona and is exploring the concept of a digital currency.

Bahamas:

Bahamas:

The Central Bank of The Bahamas launched the Sand Dollar, a digital version of the Bahamian dollar, for nationwide use.

United States:

United States:

The Federal Reserve and other regulatory bodies have been exploring the feasibility of a digital dollar, but no formal plans have been announced yet.

European Union:

European Union:

The European Central Bank (ECB) is actively researching and discussing the possibility of a digital euro, with a digital euro project expected to commence in the near future.

Singapore:

Singapore:

The Monetary Authority of Singapore (MAS) is researching the potential benefits and challenges of CBDC.

Canada:

Canada:

The Central Bank of Canada and Monetary Authority of Singapore (MAS) have jointly announced the successful 'experiment' of cross border payments using blockchain or distributed ledger technology (DLT). The two central banks claim this is the first test anywhere of its kind.

South Korea:

South Korea:

The Bank of Korea has initiated a pilot program to test the issuance and circulation of a central bank digital currency.

Russia:

Russia:

The Central Bank of Russia has been exploring the idea of a digital ruble.

Brazil:

Brazil:

The Central Bank of Brazil has launched a study group to assess the feasibility of a digital real.

Japan:

Japan:

The Bank of Japan is researching CBDC and conducting experiments to understand its implications.

Nigeria:

Nigeria:

Nigerians will be able to transact on eNaira central bank digital currency (CBDC) wallets through the Unstructured Supplementary Service Data (USSD) code on mobile phones.

These are just a few examples, and many other countries are also actively researching and considering the implementation of CBDC. The motivations behind CBDC projects can vary from enhancing financial inclusion to improving payment systems and reducing the use of physical cash.

As the technology and regulatory landscape continues to evolve, more countries are likely to join the exploration of CBDC as part of their digital transformation strategies.

Cross-border CBDC projects

Most central bank digital currencies (CBDCs) are typically intended for domestic use within their respective countries. However, some countries are exploring cross-border initiatives. For instance, in September 2021, the central banks of China, Thailand, Hong Kong, and the United Arab Emirates, in collaboration with the Bank for International Settlements, launched a pilot version of mBridge. This project aims to facilitate interbank interaction among the participating CBDCs.

The European Union is working on a legal framework for the digital euro. It is expected that a decision regarding a unified European digital currency will be made in October 2023.

Which countries take part in cross-border projects CBDC

France / Switzerland - Jura project jointly with the Bank for International Settlements

Australia / Singapore / Malaysia / South Africa - Danbar Project

Israel / Hong Kong - Sela project in collaboration with the Bank for International Settlements

Israel / Norway / Sweden - Icebreaker project in collaboration with the Bank for International Settlements

France / Switzerland / Singapore - Mariana project in collaboration with the Bank for International Settlements

France / Singapore - Onyx project

UK - Rosalinda project in collaboration with the Bank for International Settlements

Hong Kong - Aurum project in collaboration with the Bank for International Settlements

Switzerland - Helvetia project jointly with the Bank for International Settlements

Canada / UK / Singapore - Helvetia project

Saudi Arabia / UAE - Aber project

Scandinavian countries - Polaris project

Eurozone / Malaysia / Singapore / Indonesia / Philippines / Thailand - Nexus project

USA / Singapore - Cedar project

📰 MORE TOP HEADLINES